人權政策

本公司支持聯合國《全球盟約》原則,並配合聯合國《世界人權宣言》、《國際勞工組織公約》所揭櫫之目標,尊重人權並遵循各營運據點相關法規。本公司的《永續暨社會責任守則》第十四條亦規定,本公司及子公司遵守營運所在地之人權相關法規,並參考國際公認之勞動人權原則,制定符合人權標準之管理政策。其具體的執行方針如下:

- 遵循相關法令,提供健康與安全的工作環境。

- 禁用童工與禁止強迫勞動。

- 多元包容,杜絕不法歧視。

- 人員招募政策重視多元價值,不因應徵者之種族、宗教、膚色、國籍、殘疾、年齡、性別或性向等因素給予不平等待遇。

- 保障原住民、婦女、移工、契約人員與殘疾人士等弱勢或邊緣化團體的勞動權利。

- 推動性別平等政策:明訂工作場所性騷擾防治辦法及性騷擾防治申訴辦法,並加強員工教育訓練宣導;鼓勵育嬰留停員工復職。

- 誠信正直經營,反貪腐。

- 建立順暢的溝通管道,提供申訴機制。

Employee Care

Employees are the most important assets of the Company. We seek to create a friendly work environment and improve the human resource system to ensure that the Company and employees grow together and share the profits.

YFYCPG Human Resources Department plans comprehensive employee care programs, including talent development, training, performance management, salary and remuneration management, gender equality, and employee satisfaction surveys. We also hold regular employee communication meetings to explain the Company’s goals and management strategies.

To create a friendly workplace with 360-degree comprehensive care for employees, we have introduced the Employee Assistance Program (EAP), promoted gender equality, and advocated maternal care. We have established a comprehensive salary and benefits system and provide diversified leisure activities for employees to help them balance work and family life.

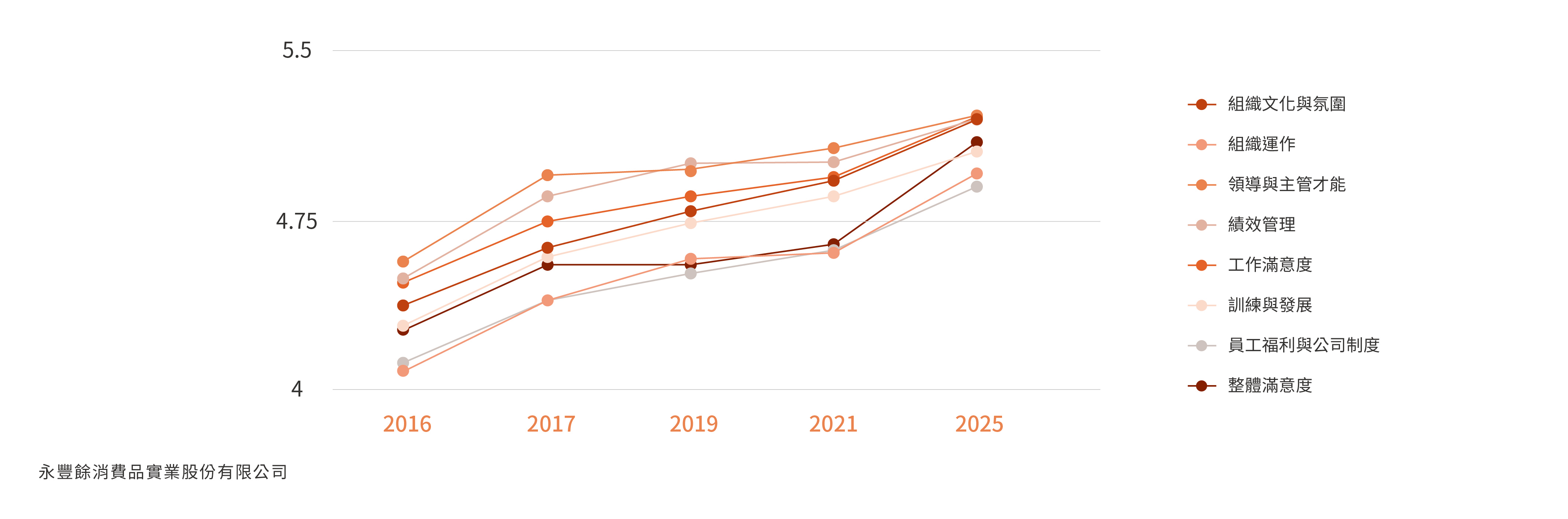

員工滿意度結果

本公司2025年員工滿意度調查係委由第三方公正機構匿名辦理,以了解員工對公司整體運作之滿意程度,並針對重大議題進行深度溝通與訂定改善計畫。本年度員工滿意度調查內容包括:組織文化與氛圍、組織運作、領導與主管才能、工作滿意度、訓練與發展、績效管理、員工福利與公司制度 七大構面。

本次調查聚焦於 2025 年度員工任職體驗,調查對象為台北總公司員工全體員工,整體覆蓋率達 94.47%,有效回收率為 84.84%。整體滿意度評分由 2016 年之 4.27 分穩定提升至 2025 年之 5.05 分(採六等量表,滿分 6 分),累計成長 18.27%,顯示員工對公司整體任職體驗之正向感受持續提升。其中,「組織運作」與「公司制度」面向分別提升 7% 與 6%,為本次調查中進步幅度較為顯著之項目,反映公司能依員工意見持續優化管理作為。

在行動計畫部分,為促進員工身心平衡與組織凝聚力,自2024年起推動「安心健康美好體驗課程」,鼓勵員工參與美術館、博物館等藝文場館,至2025年人數累計達 630 人次以上。

| 分析構面 | 平均值 | 排序 |

|---|---|---|

| 組織文化與氛圍 | 5.18 | 3 |

| 組織運作 | 4.94 | 7 |

| 領導與主管才能 | 5.20 | 1 |

| 績效管理 | 5.17 | 4 |

| 工作滿意度 | 5.19 | 2 |

| 訓練與發展 | 5.02 | 6 |

| 員工福利與公司制度 | 4.89 | 8 |

| 整體滿意度 | 5.05 | 5 |

員工滿意度趨勢

Employee Benefits Measures

Employees are the most important assets of the Company. We seek to create a friendly work environment and improve the human resource system to ensure that the Company and employees grow together and share the profits.

Overview of benefits

Remuneration and bonuses:

Sound salary structure, annual performance bonuses, employee bonus and stock option.

Medical insurance and healthcare:

Employee group insurance, employee physical checkups, labor insurance and health insurance and employee family insurance.

Thoughtful welfare systems:

Birthdays/festival coupons and gifts, subsidies for employee vacation, subsidies for cultural activities, incentives for participation in sports activities, massages by the visually impaired, discounts of company products, and gifts for celebrating marriage/pregnancy/childbirth.

The Company established the “Employee Retirement Regulations” in accordance with the Labor Standards Act and the Labor Pension Act. We allocate a suitable ratio of the total salary in the form of “pension reserve” to the Bank of Taiwan in accordance with the Labor Standards Act each month for employees eligible for the old system. For employees who opt for or are enrolled under the new system, we make a contribution equivalent to 6% of the monthly salary to the employees’ personal accounts at the Bureau of Labor Insurance.

- Chinese New Year bonus, Worker’s Day, and birthday gifts

- Subsidies for weddings, funerals, child birth, hospitalization, disability, and self-improvement activities

- Scholarships for employees’ children, and on-the-job training incentives

- Preschool educational books for employees and free subscription to monthly publications and magazines

- Retiree appreciation

- Business trip allowance

- Employee of the year and senior awards

- Group insurance for employees and their dependents

- Medical rooms in plants to ensure the occupational safety and health of employees

- Regular medical check-ups that exceed requirements of the Labor Health Protection Regulations

Leisure activities for employees:

- Employee club activities

- Employee birthday celebrations, sports competition, and travel activities

- Recreational facilities and audio-visual entertainment equipment in plants

Comprehensive retirement plan

The Company enacted the “Labor Retirement Regulations” and established the Supervisory Committee of Workers’ Pension Reserve Funds to take care of employees’ life after retirement. We allocate reserve funds for the old pension system to a special account in the Bank of Taiwan based on actuary calculation results each year to protect labor rights.

The Company also adopted the Labor Pension Act (new labor pension system) on July 1, 2005 and allocate an amount equivalent to 6% of the respective workers’ wage range to the employees’ individual pension accounts. For those that voluntarily pays additional pension, the Company deducts amounts based on the voluntary appropriation rate from the salary to the dedicated personal pension account at the Bureau of Labor Insurance.

The contents of the YFY’s “Labor Retirement Regulations” are as follows:

Criteria for voluntary retirement

- Employees who are over 55 years old and have served in the Company for more than 15 years, including services in the Company’s affiliated enterprises.

- Employees who have served in the Company for more than 25 years, including services in the Company’s affiliated enterprises.

- Employees who are over 60 years old and have served in the Company for more than 10 years, including services in the Company’s affiliated enterprises.

Criteria for compulsory retirement

The Company may subject an employee to compulsory retirement except for one of the following conditions:

- Where the employee over 65 years old.

- Where the employee is mentally incapable or physically disabled and cannot continue to work.

The mental incapacity or physical disability specified in the preceding paragraph shall be determined by the level 1 to level 6 disabilities of Labor Insurance. An additional 20% on top of the amount calculated according to Article 55, Paragraph 1, Subparagraph 2 of the Labor Standards Act shall be given to workers forced to retire due to disability incurred from the execution of their duties.

Calculation of the years of service and pension

- Employees’ years of service shall be calculated starting from the date of employment and the years of service before and after the implementation of the Labor Standards Act and the years of service after the implementation of the Labor Pension Act shall be combined for calculation. The duration shall be based on the years of actual continuous service in this Company.

- The years of service of employees assigned to affiliated enterprises to provide services or transferred from affiliated enterprises to the Company to provide services shall be combined for calculation.

- Where an employee is employed by the Company and an affiliated enterprise and applies for retirement in accordance with regulations, the total pension payment amount shall be calculated based on the ratio of the number of months served in each company and paid by the companies.

Status of YFY’s appropriation of labor pension reserve in 2020

- Year-round appropriation: NT$6,034 thousand.

- Balance of assets at the end of the year: NT$93,398 thousand.